Profit-driven optimization and the ROI>1/E model indicates that applying a uniform target ROI for the entire campaign is not optimal, and it should be adjusted according to the price elasticity occurring in different dimensions.

See the article about profit-driven optimization and the ROI>1/E model.

Applying the ROI>1/E model is not always possible. One of the main reasons is the precise determination of the conversion value, taking into account the Lifetime Value. Another typical situation is limitations related to the budgetary rigor of the campaign and the ability to finance long-term investments.

An example could be an advertiser who needs to fund campaigns from current income, for whom the optimization goal is to maximize revenue growth while maintaining a short-term ROI at certain level.

In such a situation, the profitability parameter (ROI) is predetermined, and profit-driven optimization boils down to maximizing conversion value within the set profitability.

Step 1: Classical optimisation

Classic optimisation would involve maintaining CPC costs in all dimensions of the campaign (campaigns, ad groups, keywords, times of day, devices, geographical areas) at the level of the click value (i.e., the conversion value multiplied by the conversion coefficient).

The maximum CPC rates for words where the assumed conversion cost is exceeded are reduced, and where the assumed conversion cost is not achieved, there is room for raising rates and increasing campaign efficiency.

Step 2: Adjusting for Elasticity

Assume a campaign consisting of two parts (e.g., two ad groups or two keywords) achieves the target ROI for each of these parts. We want to change the target CPC in these two parts to achieve the highest possible increase in sales (conversion value) while maintaining target ROI.

Adjustment calculation

Two parts of the campaign perform at certain ROI. We want to change the bids and maximally increase the conversion value, without changing the average ROI.

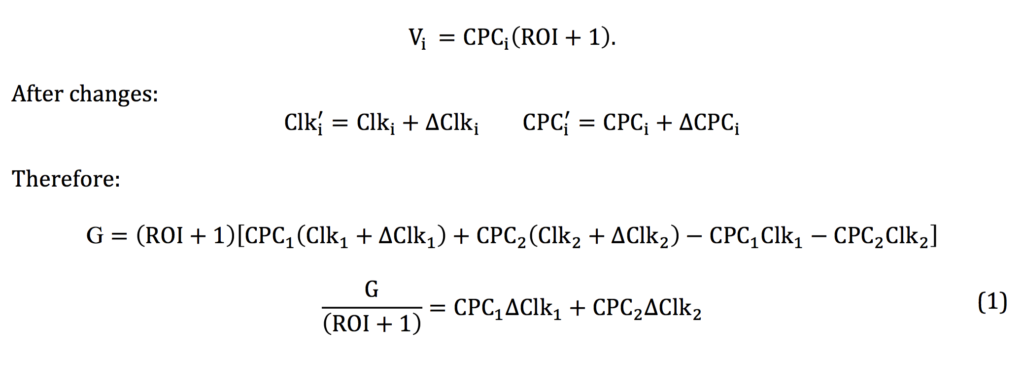

The growth (G) of the total conversion value after the change is:

– where V is the value of click and Clk is the number of clicks.

Before the changes all parts of the campaign have the same ROI. Therefore:

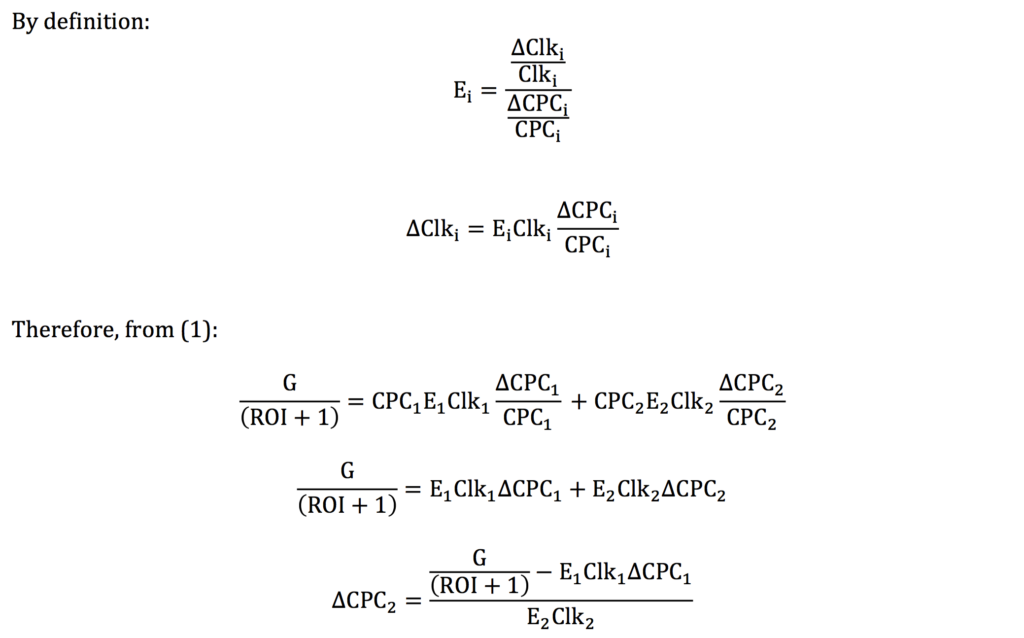

After the changes, the average ROI remains unchanged i.e. the total value of clicks is equal to the total cost multiplied by (ROI+1):

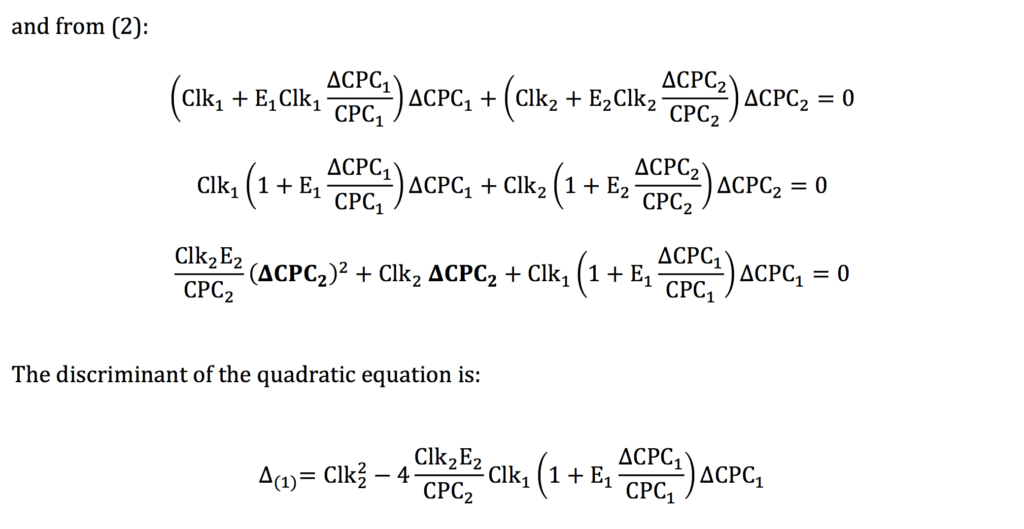

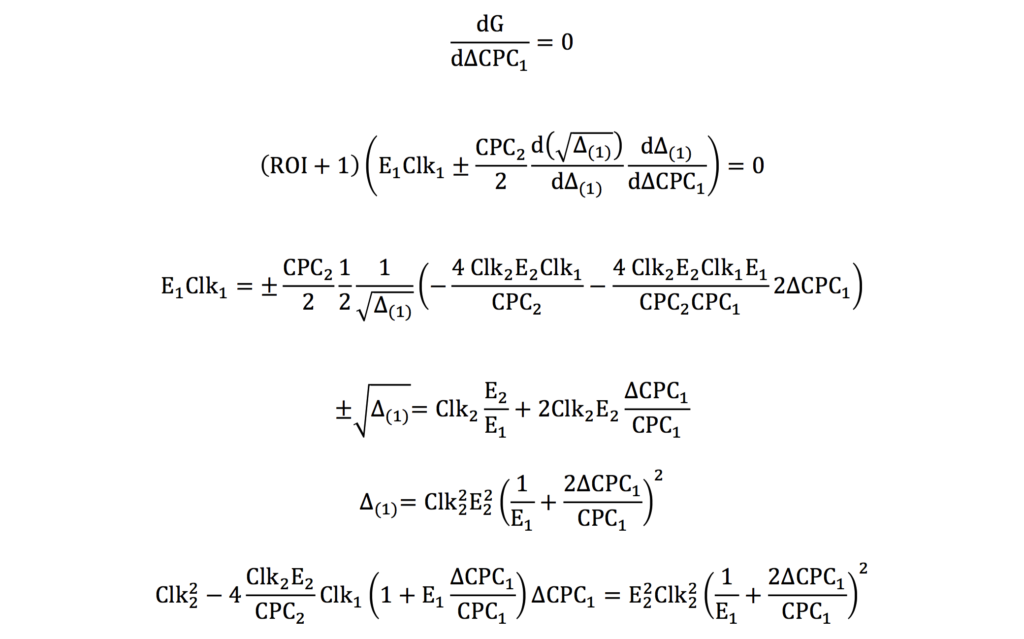

At the maximum growth (G):

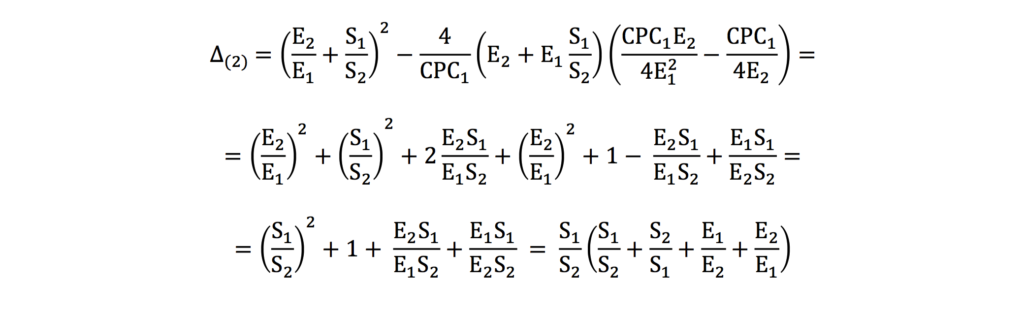

The discriminant of the quadratic equation is:

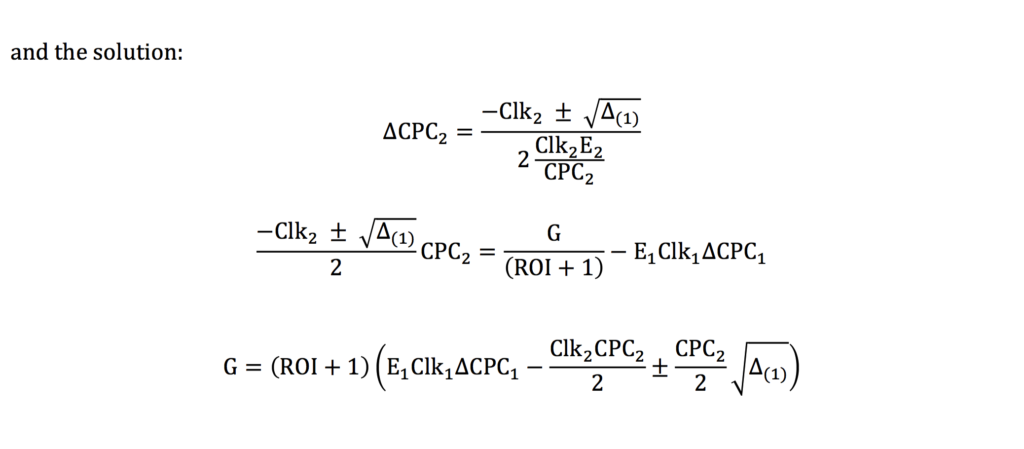

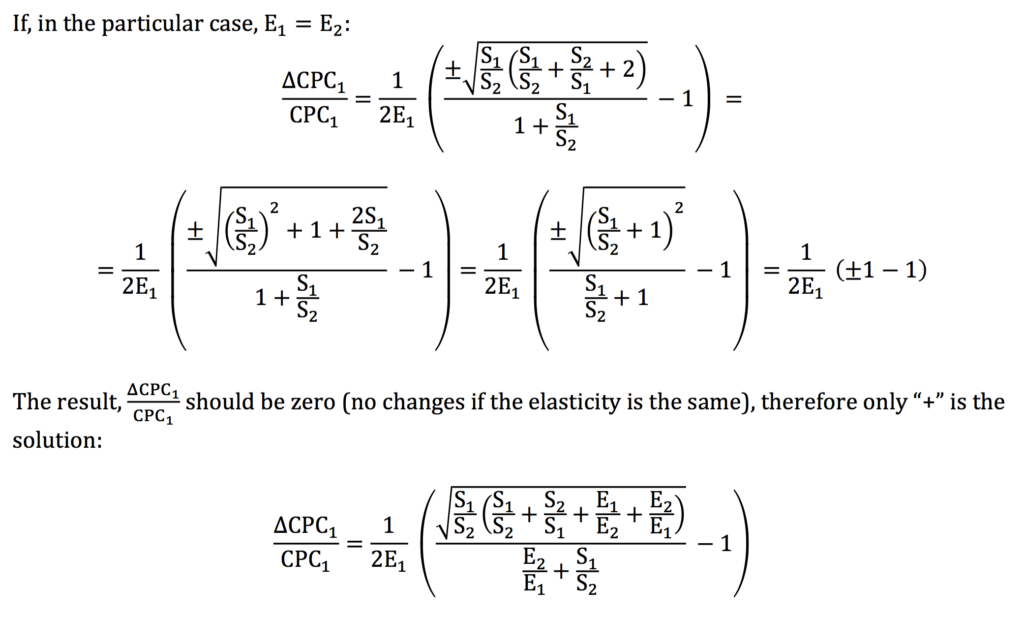

and the solution:

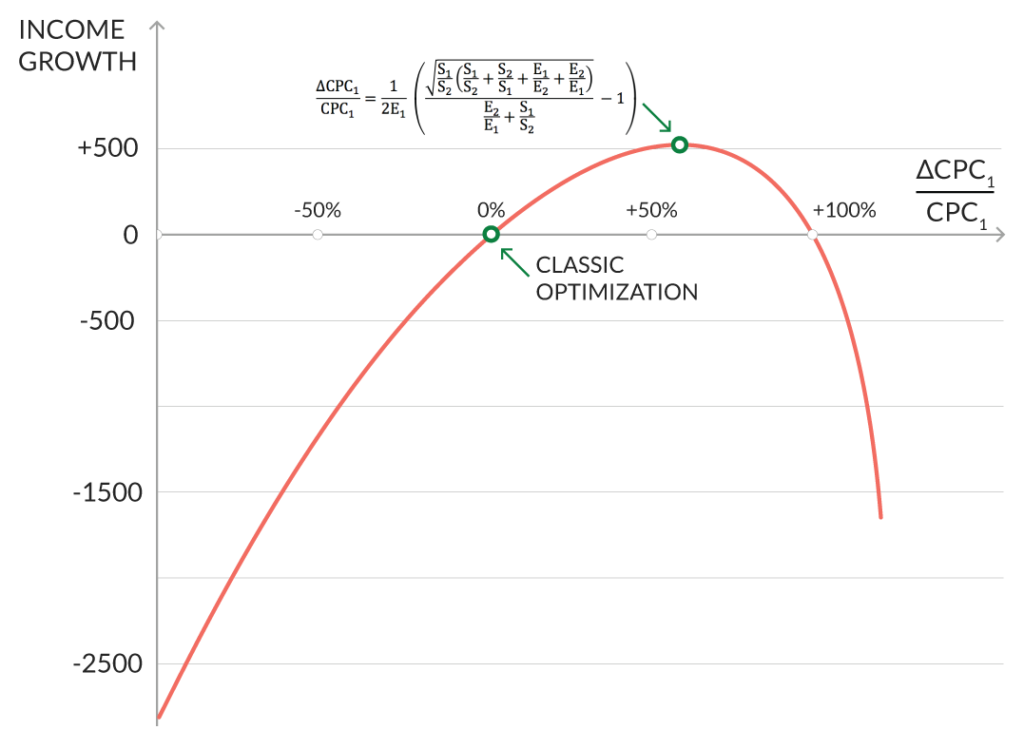

Changing CPC by ΔCPC will maximise the income without changing the total ROI:

The elasticity data are available in Google Ads interface (Bid Simulator) or via API (Bid Landscapes). The “1” and “2” may be any part/segment of the campaign: keyword, adgroup, segment. For example, “1” can be “mobile” and “2” – “desktop”, or “1” can be a keyword and “2” – all the other keywords in the campaign (in this case we should calculate total elasticity of all the other keywords).

How to calculate total elasticity of two campaigns?

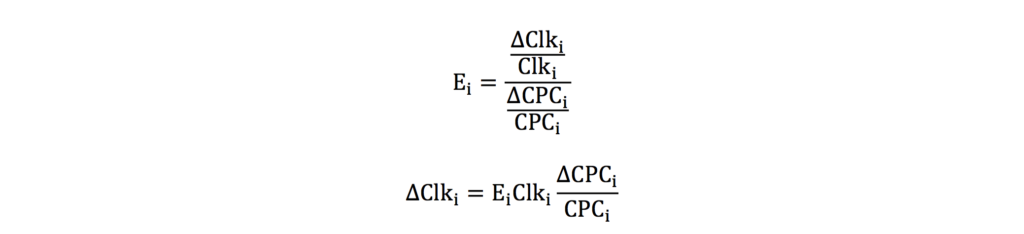

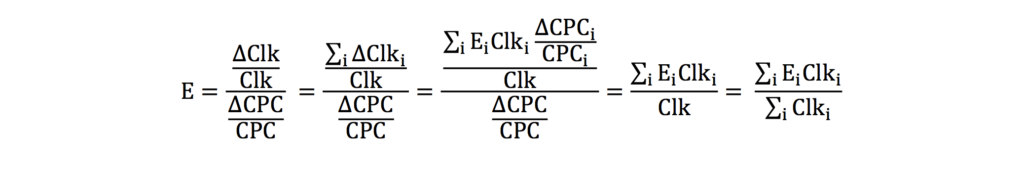

From definition:

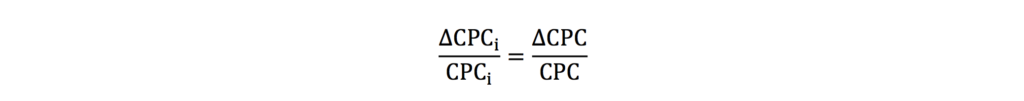

If in all campaigns the relative change of CPC is the same:

The formula for total elasticity is:

This model assumes that price elasticity does not change within the range of changes in campaigns. However, in reality, price elasticity decreases as CPC increase.

Therefore significant changes of bids may be inaccurate and sometimes may have no meaning (e.g. change of bid below minus 100%).

In practice, if the formula implies very significant changes of bids, you should not modify bids more than by 20-25% and after this modification, measure the elasticity again and continue optimisation at the next iteration.